For this month’s Reality Check, we wanted to discuss the topic which has recently highlighted in the financial media – inflation.

Here is what we don’t and can’t know:

- An acceleration in inflation is a distinct possibility as the economy continues roars back – particularly given another jolt of stimulus.

- We don’t know for sure that it will happen, when it may happen, nor the extent to which it may go on before the Fed steps in and acts to stabilize it.

- Nor can we be sure how (or even if) the equity market will react.

Here is what we do know:

- We know your goals and the plan designed to achieve your goals.

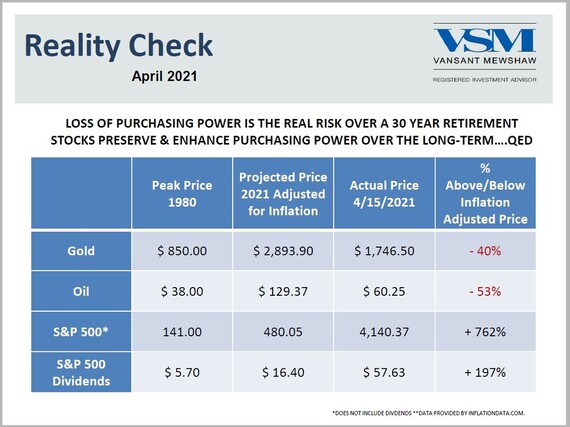

- We know that the true risk in investing is not loss of principle, rather it is the loss of purchasing power due to inflation.

- We know that the only way to eliminate this risk is through the utilization of equities.

Our approach has always been: first set goals, then make a plan, then fund an appropriate portfolio. If your long-term goals have not changed, then we always strongly recommend not changing your plan, which in turn leads us to recommend not tinkering with your long-term portfolio.

If you any questions about this topic or wish to receive our Reality Check emails, please don’t hesitate to contact us.